In Support of Bowling

Introduction

Attempting to gain perspective during a period of major change can be like being in the eye of a hurricane. You have a vivid understanding of what you have been through and fears of what is yet to come, but you lack the perspective to truly assess your situation. If you do find yourself in the eye of a hurricane, your only option may be to ride it out, fearing the worst while hoping for the best. The executive captured in the eye of major change has an option not available to the stranded hurricane victim; he can gain the proper perspective by getting above the frantic activity, far enough above it that he can see the edges and plot a course to take the organization to future success.

In an effort to gain proper perspective on where Bowling is today and the direction it must go in to assure a successful future, requires a three-step process. First, we must understand where we have been over the relevant history of Bowling. We then must project ourselves into the future to determine where we want to be at a point in time. The final piece of the puzzle will be to craft a logical plan to get from here to there.

The Three Generations of Bowling

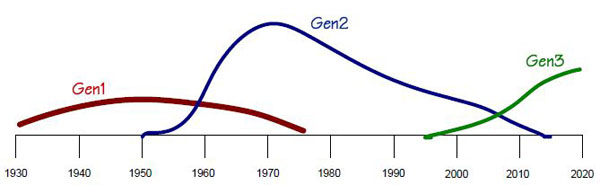

Bowling has a long history as a commercial recreation activity. The era of commercial bowling has three distinct generations spanning the last eighty years. The first generation (Gen1) occurred prior to the end of World War II. Gen2 was the Golden Age of League Bowling, beginning in the early 1950’s with its tail extending to the present day. The latest generation, Gen3 has its roots in the mid-1990’s and will continue to expand into the future.

Figure 1- The Relevant History and Future of Bowling

Gen1 – Complementary Bowling

Gen1 bowling was typically a complement to the operation of an urban bar business. Bar owners used bowling as a means of increasing both the length and frequency of a visit by the mostly male patrons. The dark, dirty, and smoky environment of an urban bar greatly contributed to the negative image of Gen1 bowling. The Gen1 bar-based bowling business was far from being a family orientated business. Women bowlers were a novelty and children were cautioned to stay away by concerned parents.

The city was the center of American life through the end of World War II. Although the automobile was well established, America was not yet the mobile culture it would become. The urban center provided employment, manufacturing, retail, and residential opportunities for the majority of Americans. The alternative to living in the city was a rural life without most of the then modern conveniences of life.

The technology of bowling in Gen1 was basic. The pin setting equipment was a moving table, which would be operated by a pin boy. The pin boy would clear deadwood, spot pins, and send the ball back after every delivery. Although pin boys typically worked two lanes at a time, the process was labor intensive. Pin boys frequently did not show up to work and were not model staff members in terms of appearance and deportment. The process of bowling in Gen1 further contributed to the image of bowling being an unsavory activity.

In the late 1930’s, Brunswick President Bob Bensinger commented on a proposal to build an automatic pinsetter, “Who needs an automatic pinsetter? Not the bowling proprietor – they don’t have the money. Even if they did, why should they buy? There are plenty of pin boys around.”1 The comment now seems reminiscent of the comment made by Bill Gates that the Internet would never have any commercial value. The Brunswick salesman who championed the pinsetter to Bensinger jumped to AMF who seized on the idea of bringing the machine to the market. Although the AMF-machine was plagued with deficiencies, they did achieve the position of being first in the market. Brunswick finally realized it was only a matter of time before the AMF equipment would be dependable for commercial use and began a pinspotter development program in earnest.

Bob Bensinger was not altogether wrong in his assessment of the situation in the late 1930’s. Urban bar owners would not buy expensive pin spotting equipment. The urban bar owner was not motivated to improve the bowling environment for his patrons. The fact that AMF introduced its first pinsetter in 1946 did not prompt a move toward automating and upgrading the bowling experience. Although the pinsetter/pinspotter would be the technological underpinning of the first bowling marketplace disruption, the cultural and economic factors were not yet in place to allow the disruption to occur.2 It would take the combination of technology and a major cultural shift for Bowling to jump generations.

Gen2 – The Golden Age of League Bowling

The decade of the 1950’s was an amazing period of change in the United States. Post World War II America was a culture on the move. The economy was booming. People were looking for new experiences, ready to leave behind the confines of cities seeking the comfort and openness of the developing suburbs. The American mindset was also different. Having gone through the challenges of World War II, Americans had a strong sense of community. People wanted to belong to organizations. They sought the recognition gained by being a part of a recognized group. Bowling along with the motel and interstate highway system became a major part of the suburbanization of America.

By the mid-1950’s, the suburbanization of America was well underway and the position of bowling in the suburban boom was being established. The marketplace for bowling was truly disrupted. The fundamental nature of a business had shifted. The location of bowling businesses shifted from the urban areas to newly developed suburban areas. The size of bowling businesses shifted from a small number of lanes to large blocks of lanes. Bowling as a product shifted from being a complement to a bar business to becoming the core of a bowling business. The ownership of businesses shifted the urban bar owners to families seeking to own their own business. A great ‘Mom & Pop’ business was created. True bowling proprietorship was born. Even the language of bowling changed. The term bowling alley became politically incorrect, replaced by bowling center. Gutters became channels and alleys became lanes. Compared to the urban bar-based bowling alleys the new centers were clean, well lit, family friendly facilities featuring the latest bowling equipment from either Brunswick or AMF. The bowling boom was in full force by 1960.

The marketplace disruption created both winners and losers. In most cases the winners were the new investors who selected good locations and built centers to accommodate the developing trade areas. The losers were the bar owners who did not make the move to the suburbs. They tended to hang on in their low cost urban locations, each year serving a declining base of aging customers.4 In a few short years, another group of losing investors developed; those who chose locations poorly and/or operated their businesses without financial discipline.

The new customers in the suburbs were being served by new business owners, bowling proprietors. The key business strategy was to build league bowling. Proprietors knew their customers and tied the business tightly around the concept of competitive bowling.

The base of league bowlers grew to over nine million by the early 1970’s. Bowling was a league-dominant business. The business of bowling enjoyed predictable cash flows. It was assumed that the league-bowling-engine would continue to hit on all cylinders. Brunswick, in 1971, reported the number of sanctioned bowlers had grown faster than the rate of the growth in the US population (14.3% compared to 11%). Although the total number of US lanes had declined 11% form 1965 to 1970, there was optimism that league bowling would continue to grow on a per-lane-basis.5

By 1973, American culture again began to shift. Americans were no longer eager to join simply to be a member6. The Viet Nam era had moved Americans away from a culture of community to a culture of individual activity. New activities were created that demanded time and attention. Fewer people were willing to commit the time and attention to become league bowlers. Over time, the number of new league bowlers did not cover the bowlers who left the sport. A long period of attrition of league bowlers had begun.

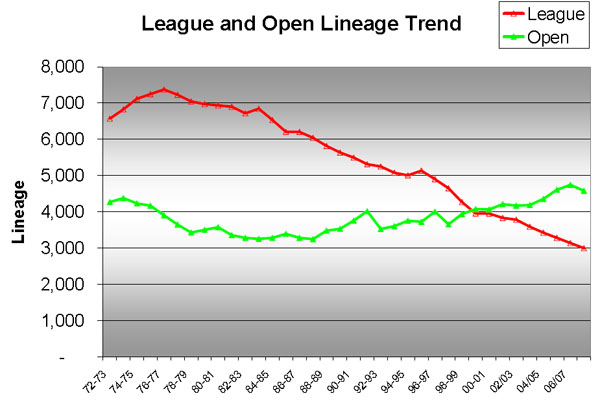

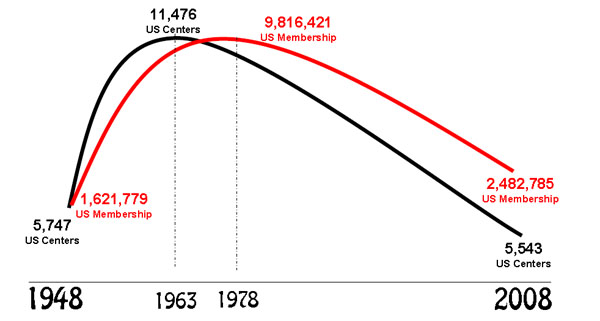

The number of bowling centers began to decline well before the number of organized participants (figure 2). To this day, the decline in the number of centers has been a stealth issue. The visible problem was the decline in membership which began in 1978.

Figure 2 – Trends and Centers and Bowlers

It is a testimony to the strength of the league-driven bowling business that the slide out of Gen2 progressed so slowly. The problem with the gradual decline, however, was twofold; at first, it was felt that with hard work the trend could be turned around. The second, more damaging problem came with the feeling that decline was inevitable. The reality is that the weakening of the traditional league base had positioned bowling for the beginning of its third generation.

The explosive growth experienced in the early part of Gen2 created the need for strong support structures. The marketplace disruption facilitated by general acceptance of the pinsetter/pinspotter gave rise to a tidal wave of new customers. The mass of people joining leagues created an administrative nightmare for the proprietor. The administration, management, and operation of a large number of leagues were beyond the capabilities of the bowling proprietor. The membership organizations, ABC, WIBC, and AJBC grew in strength along with the boom.7 Members wanted to belong and proprietors needed operational support. Although there was a strong mutually beneficial nature to the relationship between bowling operators and the membership organizations, there was also a considerable amount of friction. Each side vied for control of bowling. Major issues such as lane conditioning regulation were battled on a national level while many and varied issues were fought on the local level. In the early stages of Gen2 the primary customer of bowling centers, the league bowler, was represented by an organization which held a significant amount of power over the bowling operator. The proprietor was represented by BPAA on the national level and BPA in the state and local areas. The power of the proprietor was slow to grow, but effective at specific points in time such as the resolution of the lane conditioning issue. Away from the membership organization itself, the league officers, particularly the league secretary, held a large amount of power in a bowling center. The pocket calculator was not invented until the mid-1960’s and did not reach the general public until the late 1970’s. At the time league bowling was at its peak, all of the records of league matches, standings, and individual averages needed to be compiled by hand. The league secretary was the key to the operation and to a large degree the retention of leagues and league bowlers.

Over time, the power of the membership organization and league officers began to wane. The introduction of the ‘Automatic Scorer’ and most importantly the league records service function marked the beginning of the end of the strong control league secretaries held over bowling operators.

Gen3 – Entertainment/Casual Dominance

The move from Gen1 to Gen2 was a marketplace disruption driven by cultural change and supported by bowling machine technology. The shift from Gen2 to Gen3 is no less of a marketplace disruption. The technological underpinning for the marketplace disruption is the business information system, which had its introduction as the automatic scoring system in the mid-1980’s.

The cultural shift is the growth of the experience economy. Americans today seek out varied experiences, they want to be entertained. The emerging bowling business is marketing-driven and based in entertainment.

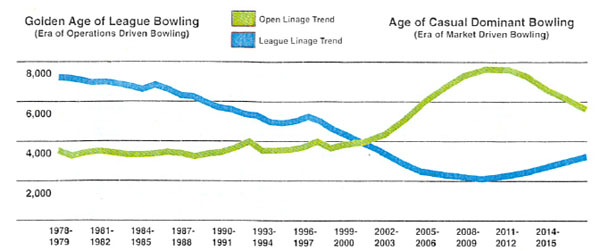

The year 2000 not only marked the turn of the century. It also marked the convergence of league and open bowling. The chart in Figure 3 appeared in the cover story of the June 2001 Bowler’s Journal.8 The data used in the charts is from the Multi-Unit Bowling Information Group (MUBIG). The data through 2000 in the original chart is the actual performance. The points of data in this chart beginning with 2001 were projections. Figure 4 provides the actual data through the 2008/09 reporting year.

Figure 3 – Lineage Performance and Projection

The projections have proven to be over-aggressive in terms of growth of Open Play. The actual trend (Figure 4) shows that Open Play bowling remained relatively flat over the entire period. It has only been in the last several years that Open Play lineage per lane exceeded the open play per lane rates of the early 1970’s. It is critical to recognize, however, that the trend in Open Play lineage from 1987 to the present is positive. The creation of the current operating environment has been much more a function of the decline in competitive bowling than the growth of open bowling. The business of bowling has survived and in most cases prospered due to the ability to increase pricing, particularly in the Open Play product groups, the ability to charge for shoe rental, and the enhancement of the Food and Beverage operation in the typical center.

Figure 4 – Actual Lineage Trends 1974 – 2009

Clearly, Bowling moved to a different place beginning in 2000. Understanding the shift is enhanced by the crafting of terminology. The first set of crafted terms deals with the possible types of bowling. Although the terms were crafted only a few years ago, they can be applied to bowling back to its beginning as a commercial enterprise.

The Spectrum of Bowling Product establishes that every bowling experience, every game bowled, can be grouped into one of four segments. Entertainment Bowling occurs when a visit to a bowling business is driven by a desire to participate in an event or a program designed to be an exciting, fun, and non-competitive experience. Examples of products included in this segment are birthday parties, corporate events, and lights, music, and video programs. A Casual Bowling visit to a bowling business is for the purpose of non-competitive bowling without consideration of programs or events. Casual Bowling is the result of a ‘let’s go bowling’-thought entering the mind of the customer. Recreationally Competitive Bowling (RC) is created by routine visits to the bowling business to compete against others, where the social and recreational value of the experience outweighs the actual competition. The vast majority of league bowling activity is Recreationally Competitive. Purely Competitive Bowling (PC) occurs when routine visits to a bowling business are made for the purpose of competing against others in the sport of bowling, where the primary intent is to win. The sport of bowling resides in the Purely Competitive segment.

The second set of crafted terms describes the relationship between the segments or more accurately the grouping of the segments. The Entertainment and Casual segments are grouped into the E/C category. The Recreationally Competitive and Purely Competitive segments are grouped in the Competitive Bowling category. Three levels of dominance are possible; Dominant, Dependant, and Exclusive. Given the previously noted two categories, there have become six possible positions of dominance:

- Competitive Exclusive – Over 90% of bowling volume is generated by the RC/PC segments.

- Competitive Dependant – Over 70% of bowling volume is generated by the RC/PC segments.

- Competitive Dominant – Over 50% of bowling volume is generated by the RC/PC segments.

- E/C Dominant – Over 50% of bowling volume is generated by the E/C segments.

- E/C Dependant – Over 70% of bowling volume is generated by the E/C segments.

- E/C Exclusive – Over 90% of bowling volume is generated by the E/C segments.

At the peak of the Golden Age of League Bowling, the bowling operating business was highly Competitive Dependant. Many individual businesses were in fact Competitive Exclusive. Over time, the dominance of Competitive Bowling shrank until in 2000 the E/C and Competitive categories converged. In the ensuing years, the degree of E/C Dominance has continually increased. Today, many traditionally structured bowling businesses are approaching E/C Dependence with a significant number of bowling concepts being developed as E/C Exclusive. The pendulum is swinging. The reality of the marketplace is that movement from dominance through dependence to exclusivity creates volatility. One reason the boom in bowling came to an end is that operators embraced the security of Competitive Bowling to the point of excluding the development of new customers through the offering of Open Play bowling.

The swing toward E/C Exclusive bowling contains more volatility than did the swing toward Competitive Exclusivity. There are several reasons for the increased volatility:

- The frequency of customer visits is much lower in E/C exclusive environment. A much higher level of traffic is needed to create the same annual lineage.

- The average price per game for E/C bowling is higher than the typical league pricing10.

- Food sales are a more significant part of the business, carrying a higher cost of goods and an ability to downsize the total cost of the bowling visit.

The recession of 2008/09 provides ample proof for the need for relative balance in an operating bowling business. High profile, attractive E/C Exclusive concepts are suffering with depressed volume making the higher fixed and operating costs a threat to the financial viability of the business.

Several models for bowling-based business have developed to address the shift from Gen2 to Gen3.11 It is interesting to note that one model returns bowling to its Gen1 role of being a complement to another core activity.

Currently, two companies are leaders in this category. Lucky Strikes uses bowling as a complement to a bar business while bowling at Incredible Pizza is used as a complement to a family restaurant. The second model ‘New Twos’ ignores the changes in the marketplace and attempts to create a new edition of a traditional bowling center. The third model, Core Bowling, Leisure accepts that bowling is the driver of the business, but only seeks to serve entertainment and casual customers, avoiding bowling products targeting competitive bowlers. The fourth model is the Family Entertainment Center (FEC). An FEC typically has a large bowling piece, but also seeks to drive destination traffic to other profit centers. The final model is the full spectrum bowling business, a core bowling concept, which creates bowling experiences in all four segments of the spectrum of bowling products.

Supporting Gen3

The classic quote, “A journey of 1,000 miles begins with a single step”, by Chinese philosopher Lao Tzu, is intended to keep us focused on taking the first step and then the next step. The achievement of a long-term goal is as simple as placing one foot ahead of the other and then pushing forward ever so slightly.

The problem is that the single-step-method has a strong tendency to project the past into the future. How do we know when to turn, when to jump? The answer is that we need to respect where we have been, we have to know where we are, and we need a concrete vision of where we want to be at a specific point in time. After all of that, we can develop a plan to move in that direction with the understanding that no matter how good the plan, there will be seemingly constant adjustments in speed and direction. Knowing where we want to be requires us to pick a point in time, define our future position with the utmost clarity, and then make the leap into the future.

The appropriate horizon is twenty years. Anything shorter would cause us to be willing to adjust rather than re-create. The point in time we need to look to is 1/1/2030. Bowling has been an enduring commercial activity. Bowling has proven to be the most successful form of commercial recreation ever developed. Properly directed, Bowling most certainly can enjoy a future as successful as the past. By necessity, however, the continuation of success requires a continuation of change.

What will Bowling in 2030 look like? What will it feel like? What will be the nature of the business, or the bowling experience? The answers to these questions begin to create the basis for a 2030 Plan.

To be of value, this “futuring” exercise must be based on certain conditions:

- The acceptance of the Spectrum of Bowling Product (Entertainment, Casual, Recreationally Competitive, and Purely Competitive) as a means of grouping bowling experiences.

- The physical activity of bowling remains essentially unchanged.

- The physical foot print of bowling remains unchanged. Lanes will remain the same length and the percentage of customer trafficked area to total space in the building will remain relatively low.

Additionally, certain assumptions need to be made about the American way of life in 2030:

- Americans will have an adequate amount of disposable income to allow for various forms of leisure activity.

- The cost of building bowling-based businesses will continue to be a significant barrier to entry for new competition.

- The American public will be further dependent on technology to plan and conduct every-day life experiences.

- The acceptable level of service quality will be higher than today.

- Family and Community will continue to be fundamental to the life of the average American.

- The free market economy continues to be a fundamental part of American culture.

Picture Bowling 2030

The 2030 calendar year starts with a total of 3,500 operating bowling businesses in the United States. With an average of 24 lanes per business the total number of US lanes is 84,000. Efforts to maintain a balance between the four segments of the Spectrum of Bowling Product have been relatively successful with the 2029 nationwide balance being:

Entertainment 35% Casual 30%

E/C Category 65% Recreationally Competitive 32%

Purely Competitive 3% Competitive Category 35%

The number of games per lane per year in 2029 was 8,900. Total US lineage for the year 2029 was 747,600,000. The average season length of a bowling league was 24 weeks with three games being bowled each week. The average league bowler bowled in 1.2 leagues per year. Nationwide, 3% of all games bowled were categorized as being tournament bowling. The total number of league bowlers in 2029 was 2,950,000. The count of youth league bowlers was 350,000. Senior league bowlers totaled 235,000.

The number of bowling centers declines from the current 5,400 due to the changing nature of trade areas. Centers are lost when the value of the property increases beyond the economic value of the going concern. Centers are also lost when the economic value of the going concern fails to provide an acceptable return to its investors. The development of new bowling centers is limited by the total cost of building a bowling center.

In 2029, the predominating operating model is the Full Spectrum center. The fixed and operating costs require the facility to have reasonable lane use throughout the week rather than an absolute dependence on driving business into weekend dayparts.

The balance of revenue generation shifts slightly from the current standard revenue allocation of 50% Direct Bowling Revenue (DBR), 15% Ancillary, and 35% Complementary to be 40% DBR, 23% Ancillary and 37% Complementary. The change is based on the conversion of Pro Shop rent revenue into Skill Center Income (Ancillary) and further enhancement of Food & Beverage Income.

Bowling in 2029 continues to be a community-based business. The typical ownership structure is to have an investor owner and a manager operator. The true Proprietor, an owner/operator, has declined to be less than 50% of all owners. Some consolidation of ownership has occurred. The most common multi-unit ownership structure is to have three centers in a single geographic area. There are several chains of over 100 centers operating on a national basis. The typical center is in a suburban area. The newest centers tend to be far away from urban or prime suburban centers.

Supporting Bowling in 2030

The previous picture of bowling is rather positive. Competitive bowling is doing well, maintaining a 35% portion of growing total lineage. The number of centers is lower, but the economic viability of the bowling operating business is not in question. I personally would be pleased if the picture presented was reality in 2030. Most certainly, a much darker scenario can be presented. The value of this exercise is not to attempt to create either the case or the worst case scenario for 2030. It is to present an acceptable picture and then create a plan to get there.

The presented picture of bowling circa 2030 cannot be achieved with the current structure support organizations. Major steps have been taken to realign the overall support structure. The creation of the International Bowling Campus (IBC) is a major step in creating a support structure, which will provide support for Bowling in the future. The work that has been done to this point in time has been foundational. We now need to build on this structure to create a new generation of support to bowling for a new generation of bowling.

The most important fact in understanding the need for support and the structure of that support is that Bowling is first and foremost a commercial activity. If you take care of the business, you will have the ability to take care of everything else. There is no Bowling if there is no bowling operating business. Gone are the league members. Gone are the tournament bowlers. Gone is the Hall of Fame. The first order of business in supporting bowling is to identify the needs of operating bowling businesses.

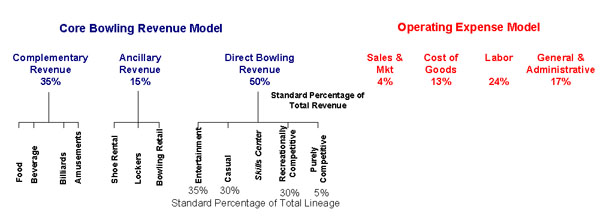

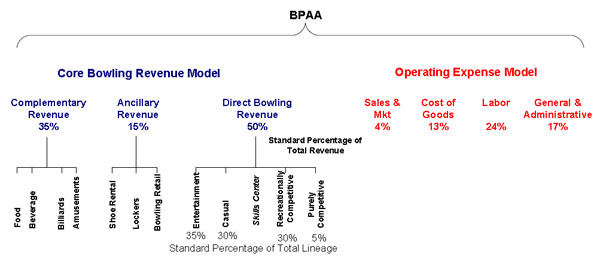

Although an operating bowling business can be organized in many ways, the majority are structured similar to Figure 5.

Figure 5 – Bowling Operating Model

In a core bowling business the most important part of the business is the sale of a bowling experience, by the game, hour, or event. A typical Core Bowling business generates approximately 50% of Total Revenue for Direct Bowling Revenue, the payment for a bowling experience. Approximately 15% of Total Revenue is the Ancillary Revenue category, items directly related to the experience of bowling. The primary components of Ancillary Revenue are Shoe Rental and Bowling Related Retail (Balls, Bags, and Shoes). The third major category of revenue is Complementary Revenue, sales of items which enhance the experience of being in a bowling center. Examples of Complementary Revenue are Food Sales, Bar/Lounge Sales, Vending, Billiards, and Amusements. Typically, Complementary Revenue comprises approximately 35% of Total Revenue.

As mentioned previously, Direct Bowling Revenue (DBR) has four component segments, which, when taken together, comprise the Spectrum of Bowling Product. The mix between segments varies by location and by strategy.

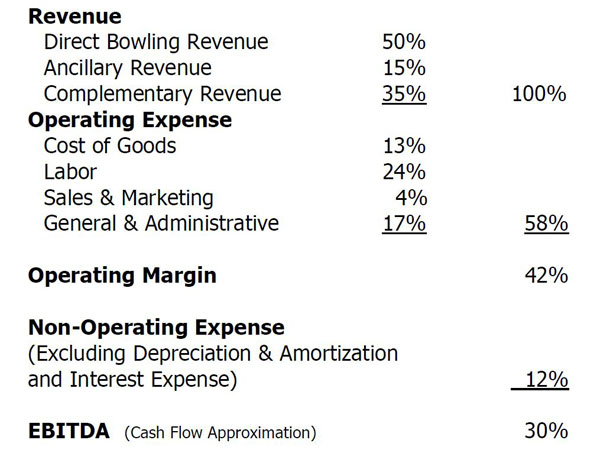

The Operating Expense Model is standard for all bowling businesses, although there are wide differences in the chart of accounts for different businesses. One business may treat a certain account as an operating expense whereas the same expense is treated as a non-operating account by a different business. The standard model as outlined in Figure 5 creates a profit model as follows (Figure 6).

Figure 6 – Generic Bowling Center P&L Structure

All support for bowling must in some way relate to the operating financial structure of bowling centers.

BPAA

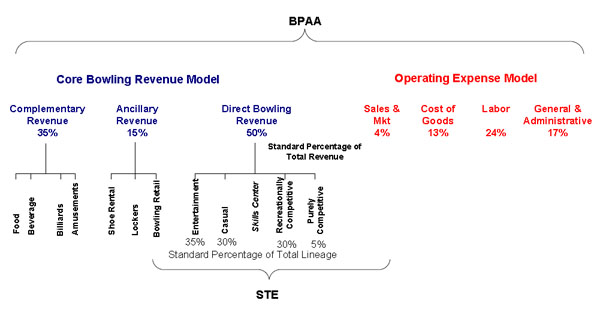

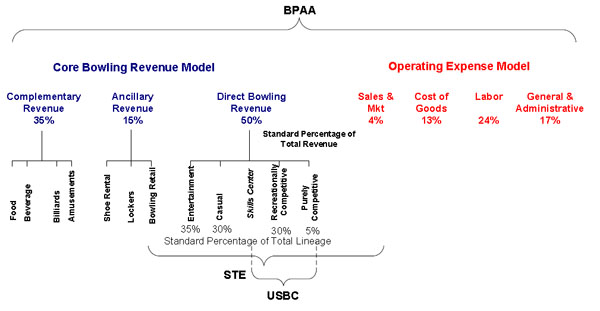

The mission of the BPAA is to enhance the profitability of its member centers. This mission requires the BPAA to support either directly or through support of other organizations each aspect of the Bowling Operating Model (Figure 7).

Figure 7 – BPAA Span of Influence

The BPAA currently fulfills its mission as follows:

- Support of STE

- Support of USBC

- Operation of Smart Buy Programs (including Pepsi)

- Operation of Education and Training Programs

- Advocacy on critical national issues

- Support of the BPA Network

- Major Program Development (i.e. Bowlopolis)

The BPAA has been successful in fulfilling its mission over the past decade. Its ability to do so in the future will to a large degree depend on the ability of leadership to have clarity on the current role of the BPAA in Bowling and the role the BPAA needs to play in the future of Bowling.

A major strategic decision is about to be made, which may significantly influence the future of the BPAA and therefore the ability of Bowling to achieve something, resembling the 2030 picture previously presented. The decision relates to the structural relationship between the BPAA, USBC, STE, HoF, and the PBA. The disbanding of the STE and HoF Boards has been discussed as a strategy, which would consolidate the operating control of Bowling. The logic is that the BPAA and USBC staff, with the support of their respective Boards, are better suited to deal with the issues involved in marketing Bowling and the operation of the Hall of Fame. It is my belief that such an action would prove to be detrimental to the future of Bowling. There are unique roles to be played by support organizations. Having separate Boards for the HoF and STE allows for individuals with particular interests and abilities to be focused on a narrow portion of the world of Bowling. The absence of separate Boards relegates the volunteer oversight and support of the HoF and STE to the BPAA and the USBC Boards. Such action effectively removes input by qualified individuals from both the HoF function and the sales and marketing function.

The loss of STE would be a particularly powerful blow to the potential for success of Bowling in the future. The future of Bowling is dependent on our ability to sell the experience of Bowling to a generation beyond the Golden Age of League Bowling. We have worked our way through the large bubble of Gen2 Bowling. Gen3 can be a very successful time for Bowling, but it will take a leap in marketing and selling skills both on the support structure level and in neighborhood bowling centers to realize that potential. A strong STE has the potential to successfully provide the support needed to realize the 2030 goal. Marketing as a functionally integrated department of the BPAA and USBC will fail. A failure which, if it occurs, will take with it the possibility of extending the life of Bowling to the envisioned twenty-year horizon.

STE

The mission of STE is to increase the number of US paid games per lane per year. It is the correct mission. It allows STE to become focused on meaningful strategic initiatives created to drive paid games of bowling into US bowling centers. The span of influence for STE is presented in Figure 8 below.

The STE span of influence covers the entire Spectrum of Bowling Product and additionally the bowling retail function of Ancillary Revenue and the Sales and Marketing Expense function of Operating Expense.

Figure 8 – Span of Influence of STE

STE has had an interesting history. Its original mandate was to provide a spectrum of full service marketing services to Bowling. A heavy investment was made without significant results. After several years, STE was whittled down to effectively being a sponsorship sales and activation organization. It was successful in creating enough sponsorship and activation fees to cover its operating expense and created a reasonable amount of reserves. Several years ago, efforts were made to broaden the strategic perspective of STE to again be a full service marketing support organization. Today, STE is stuck somewhere in between strategies. The fact that STE is not an effective full service marketing company today in no way diminishes its potential to serve Bowling in a critical way. One only needs to look to the corporate story of Apple to see that strong leadership can change a drifting organization into a strong organization by setting a relevant strategic direction and relentlessly holding people accountable for executions against strategic initiatives. In July 1997, Apple was only a matter of a few months away from filing bankruptcy when Steve Jobs was brought back as CEO. Jobs re-crafted the strategic direction of Apple. Through his efforts to keep the company strategically focused, Apple was able to reassert itself as a leading innovator in computers along with launching the incredibly successful iPod, ITunes, and iPhone product lines.

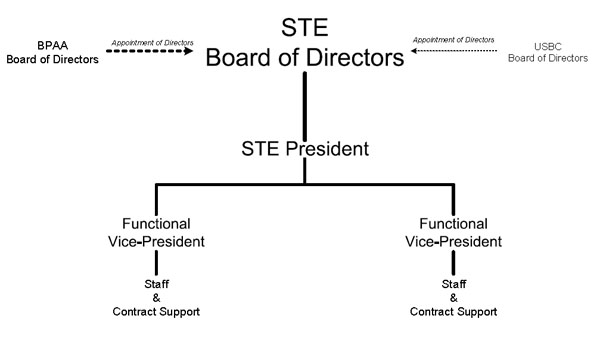

The proper structure for STE (Figure 9) is to have a strong Board providing oversight and direction to an executive leadership team headed by a President whose sole function is to lead STE. The remainder of the executive team would be functional Vice Presidents who would either directly manage assigned staff or manage out-sourced resources with the intent of achieving each strategic imperative.

Figure 9 – STE Structure

The Board structure should be no larger than nine in total. The BPAA would have four allocated seats, one of which would go to the BPAA Executive Director. The remaining three would be based on the approval of the BPAA Board after evaluation of candidates by the BPAA Nominating Committee. The USBC would have two seats on the STE Board, one of which would be assigned to the USBC Executive Director. The other USBC seat would be filled directly by the USBC Board. The remaining three seats on the STE Board would be filled by action of the STE Board.

The process of creating a strong STE would begin with a strategic planning session. The session would start with a review of past strategic functions. Each can be evaluated not from the perspective of whether meaningful progress has been made against their achievement, but rather whether each is meaningful to the achievement of the STE mission in the future. The previously identified list of strategic functions included:

- Research

- Product Development

- Public Relations

- Skill Center

- Sponsorship Sales

- Fulfillment and Activation

Additional items require consideration for inclusion:

- ‘e’ marketing solutions for bowling operators (i.e. social networking, web driven sales, and reservations)

- Compelling Competition for Mass Audiences

- Membership Retention and Development Strategies

Marketing and Sales will be the heart of the successful bowling operating business in the future. It is an emerging area, which needs the time, attention and dedication of a group of people (Board, Executive Management, and Staff) in order to provide the energy and effort needed to take Bowling into the future.

USBC

The mission of the USBC is to be the National Governing Body of the Sport of Bowling. It is stuck, however, in a model of being a membership organization where its membership seeks tangible value in return for dues paid. This inherent conflict assures the USBC will be largely ineffective as a support organization for Bowling. It will be impossible to achieve the 2030 goal without a viable National Governing Body and without a functioning membership organization.

The Span of Influence of the USBC is provided in Figure 10.

Figure 10 – Span of Influence of the USBC

The USBC is focused on the Skills Center, Recreationally Competitive Bowling, and Purely Competitive Bowling. While the scope of USBC activity seems narrow, it is exceedingly important. Within the USBC scope of activity are critically important items such as:

- Rule Making for Recreationally Competitive and Purely Competitive Bowling

- Inspection and Rule Enforcement

- Specifications and Testing

- Coaching

- International Presence

- National/International Draw Competition

• Conducting Events in the US

• Fielding Teams to Participate in International Events - Compelling Competition for Mass Audiences

• Professional

• Collegiate

• Youth

• Team

• Individual

• Open

• Mixed

The future of Bowling is best served by a realignment of functions between STE and the USBC. As noted previously, there has been a historic conflict between the mission of the USBC and the expectations of its members. The mission fits the needs of Bowling going forward. The expectation of the current members of the USBC must also be served. The mechanism for having both is to shift the membership support function from the USBC to STE. STE will operate membership on a value-to-member-basis. The STE membership operation will have two membership components; Bowling Operators and Bowlers. Value to Bowling Operators will be through enhanced bowler development, league development, and bowler retention efforts. Value to Bowlers will come from tangible items such as awards, recognition, and communications. The dues support structure will shift from being 100% Bowler paid dues to either a blended model with greatly reduced individual fees or in the best case completely bowling center paid dues structure.

The STE operation of Membership will be completely separate from the operation of the USBC. To facilitate this separation, the legacy brands of the ABC, WIBC, and YABA can be brought back to provide a marketing and operating structure for the STE membership function. The existing membership management infrastructure of USBC will be used to operate the STE Membership strategic function.

The USBC will be funded by a combination of an annual grant from STE and net proceeds from conducting International/National competitions (i.e. USBC Open Championships, USBC Women’s Championships, and Junior Gold).

PBA

The strategic plank of providing Compelling Competition for Mass Audiences brings into focus the “PBA issue”. The PBA is a legacy structure within Bowling. The PBA has been the most highly visible face of the sport of bowling since its initial inception in 1958. ABC Sports ending the 36 year run of the Pro Bowler’s Tour in 1997. The PBA struggled through several years until in 2000 the PBA was purchased by Rob Glaser, Mike Slade, and Chris Peters, all former Microsoft executives. The purchase ended the existence of the PBA as a player’s association and began the era of the PBA as a profit seeking entity.

The new ownership made a tremendous commitment to the success of the PBA. Talented executives were brought into the PBA to drive the business to the point of being able to provide an acceptable return to its owners. The owners’ financial commitment totaled in the tens of millions of dollars since the purchase was completed.

The PBA has not proven to be successful as a profit generating entity. It is, however, the best platform on which to build the Compelling Bowling Competition for Mass Audiences plank of the USBC strategic plan.

Unfortunately, the combination of the relocation of the USBC, the creation of the IBC, and a sour market for investments has left both the USBC and the BPAA without the financial resources needed to bring the PBA fully into the fabric of the strategic partnership between the BPAA and the USBC. The PBA has value to Bowling in the long term. It would seem inevitable that the ownership group will at some point in time decide to withdraw support. Creating a plan to protect the long term viability of compelling bowling competition for mass audiences must be high on the list of projects for Bowling leadership.

Conclusion

Bowling has faced and overcome many challenges in the past. The current challenges can also be overcome and a successful future be earned for Bowlers and bowling operators. The decisions and efforts made over the next several years will have a great impact on the success achieved two decades from now.

Advocates of “ObamaBowl”, the concentration of all power and control in a single national structure, are well intentioned, but fail to see the value to be gained by the inclusion of people under the umbrella of 621 (IBC). The value of the 621 model is to integrate functional components to become a machine, which will work to support Bowling in the future. The elimination of volunteer participation at a Board level other than the BPAA and USBC Boards is bad strategy. The 621 Plan currently being developed needs to stress the assembly of the machine. Although at times leverage and raw strength are needed to construct a functioning machine, care must be taken to avoid slamming together components in an effort to just make it work today.

Over the course of this paper, I have presented a number of steps to be taken to assure the current and future leadership of Bowling has the opportunity to enhance the legacy we have each been granted. In summary, the key steps are:

- Increase the pace of functional integration within the IBC without losing the identity of the individual organizations.

- Accept the Spectrum of Bowling Product definitions of the segments of bowling products (Entertainment, Casual, Recreationally Competitive, Purely Competitive).

- Accept the Dominant, Dependent, Exclusive model for describing the shift in Bowling over the eighty years.

- Accept that Gen3 must have a substantial Competitive Bowling component if Bowling is to be a healthy, commercial activity on a national scope in 2030.

- Allow for inclusion of individuals on a volunteer-basis who have an interest in focused areas of Bowling by assuring Board participation is not limited to the BPAA and USBC Boards. The STE, Hall of Fame, and the Bowling Foundation Boards can all support the effective operation of the IBC.

- Create a nine-person-Board to govern STE.

- Hire a STE President to lead in the achievement of STE strategic imperatives.

- Shift the membership function from the USBC to STE, allowing the USBC to function as the National Governing Body of the Sport of Bowling and allowing STE to create direct and tangible value to its core memberships groups; bowling operators and Bowlers.

- Bring the PBA into the IBC and work toward protecting the ability of Bowling to present compelling bowling competition to mass audiences in the likely event the PBA ownership withdraws their support to the PBA as a profit seeking entity.

The ideas, concepts and opinions in this paper are intended to stimulate discussion rather than being the definitive solution to the challenges of future. I encourage all readers to challenge any part of this paper. I would welcome being convinced that there is a better basic framework for creating the future for Bowling than this initial attempt on my part.

Joe Schumacker

schumacker@earthlink.net

August, 2009